Tesla Breaks Qualcomm’s Grip: Samsung’s 5G Modems Move In

The long-standing Qualcomm monopoly inside Tesla’s connectivity suite has finally cracked. In a move that reshapes the silicon power dynamics of the electric vehicle industry, Samsung has secured its first-ever deal to provide 5G modem solutions to the American automaker. The partnership begins with an immediate deployment in Tesla’s Robotaxi fleet, signaling a calculated departure from Tesla’s historical reliance on Qualcomm and a massive validation of Samsung’s automotive ambitions.

Samsung Connectivity Enters the Tesla Ecosystem

This isn't just a pilot program; it is a full-scale transition from development to the production line. Samsung’s System LSI Business—utilizing the technical heritage of its Exynos modem architecture—has finalized a 5G solution hardened specifically for Tesla’s unique hardware environment. After months of rigorous validation, mass supply is scheduled to ramp up within the first half of 2026.

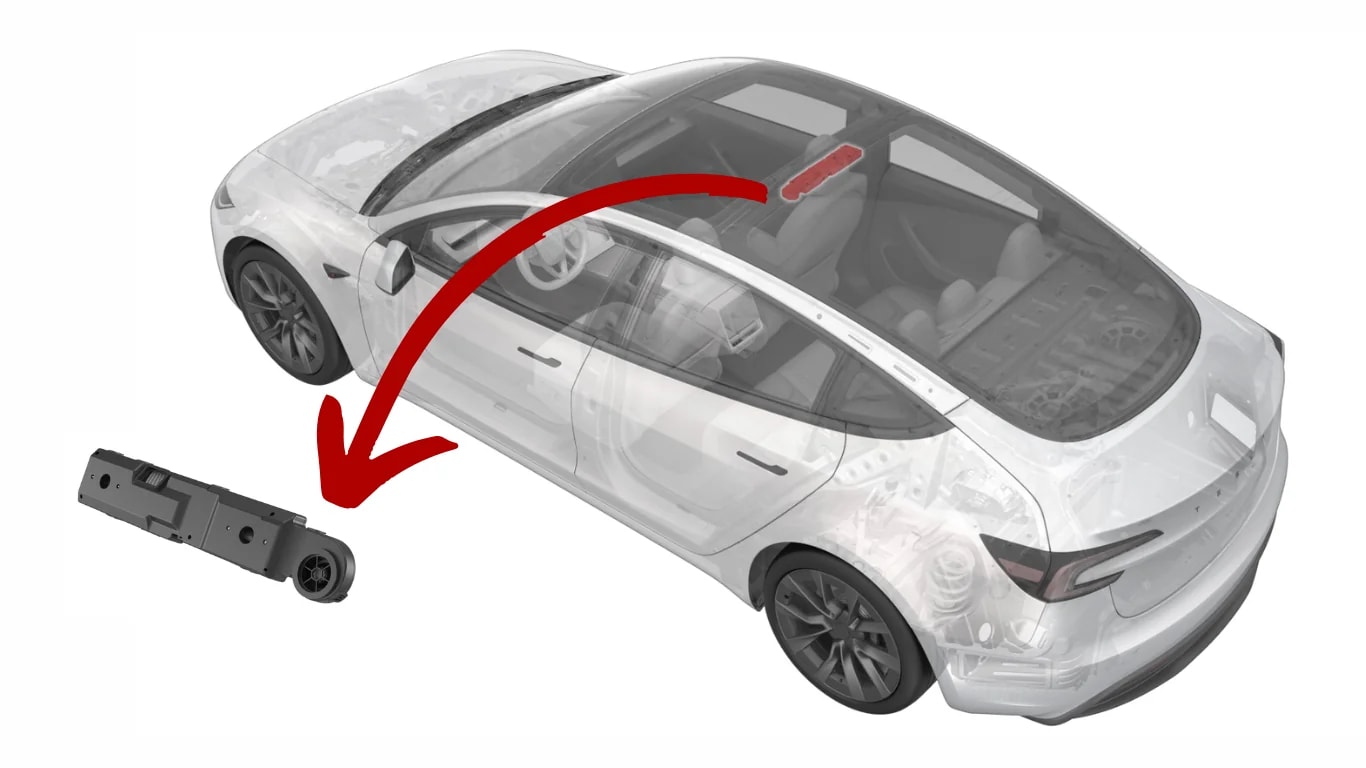

The first wave of hardware is earmarked for the Robotaxi fleet operating in Texas. While the autonomous platforms serve as the vanguard, industry insiders confirm this is the start of a broader standardization. Subsequent hardware batches are expected to filter into the Model 3 and Model Y refresh cycles as Tesla moves to unify its connectivity stack under the Samsung banner.

This agreement traces back to the high-level roadmap established in May 2023, when Samsung Executive Chairman Lee Jae-yong and Elon Musk met at Samsung’s Silicon Valley research hub. That meeting, which initially sparked rumors of AI chip collaboration, has now matured into a multi-billion dollar telecommunications reality.

Engineering for Autonomy: Beyond Smartphone Specs

Automotive 5G is a different beast than the silicon found in a flagship handset. To survive the Tesla integration, Samsung’s modems must maintain performance under extreme thermal cycling and constant chassis vibration, with a target reliability window exceeding ten years.

For the Robotaxi, 5G isn't a luxury—it is a functional necessity for Vehicle-to-Everything (V2X) communication. These modems provide the low-latency telematics required for the vehicle to interact with municipal infrastructure and Tesla’s cloud intelligence in real-time. By leveraging this dedicated 5G pipe, Tesla can offload massive datasets from its Full Self-Driving (FSD) sensors, allowing the car to "see" around corners through shared network data, far beyond the reach of its onboard cameras.

The Geopolitical Pivot: Why Samsung, Why Now?

Tesla’s shift to Samsung is a textbook execution of its "NCNT" (No China, No Taiwan) supply chain strategy. While Qualcomm remains a formidable player, its fabless model leaves it tethered to third-party foundries—often in Taiwan. Samsung, conversely, offers a unique vertically integrated solution. By designing the modem and manufacturing it in-house, Samsung provides a level of supply chain transparency that Qualcomm’s fragmented production cycle cannot match.

The "geopolitical safe haven" of Taylor, Texas, is the linchpin of this deal. This 5G agreement cements a broader $17 billion collaboration that includes the production of Tesla’s next-generation AI compute (the A16) at Samsung’s Texas facility. By sourcing both the logic (AI chips) and the baseband (5G modems) from a single partner with a massive U.S. manufacturing footprint, Tesla is effectively insulating its "Level 5" future from the volatility of the Taiwan Strait.

For Samsung, the win is transformative. It moves the System LSI and Foundry divisions beyond the smartphone market and places them at the center of the most lucrative vertical in tech: the autonomous software-defined vehicle.