Sodium-Ion Battery Technology: Deep Analysis of Performance, Cost Advantages, and Industrial Scaling

For $100, you can buy roughly 1kWh of Lithium Iron Phosphate (LFP) today, but sodium-ion is knocking on the $40 door. This price gap—not just environmental idealism—is the primary reason sodium is finally moving from chemistry journals to the factory floor. While the lithium price crash of 2024, which saw lithium carbonate plummet to the $13,000/ton range, made the "sodium imperative" a harder sell to skeptical investors, the long-term strategic play remains. Sodium offers a hedge against the geographical chokeholds and extreme volatility inherent in the lithium and cobalt supply chains.

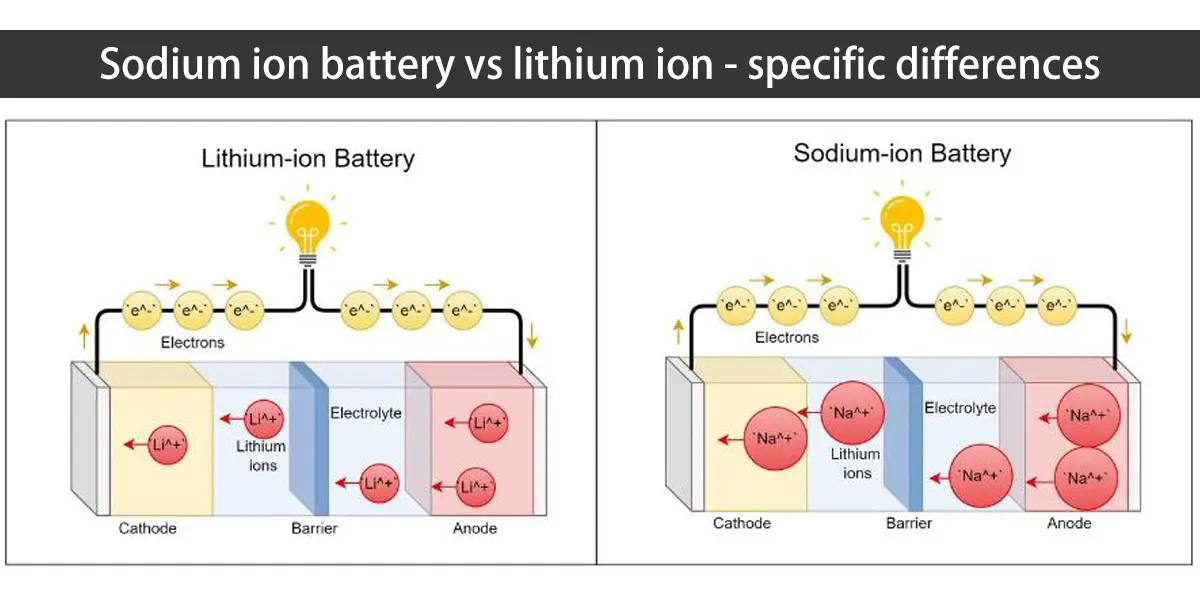

The Architectural Shift: Sodium’s Chemical Blueprint

Sodium-ion batteries (SIBs) operate on the same "rocking-chair" principle as lithium-ion batteries (LIBs), shuttling ions between a cathode and an anode. However, sodium’s larger ionic radius and higher atomic mass demand a different material toolkit.

Wh/kg: Investors Are Missing the Point

Cold Weather and Power Delivery

Sodium-ion technology is a beast in extreme environments. Many SIB chemistries retain most of their capacity at -20 °C, a temperature where LFP batteries essentially freeze up. This makes sodium the obvious choice for stationary storage in northern climates. The high rate capability of certain SIB designs, especially those using PBAs, allows for 1–4C continuous discharge. This is perfect for frequency regulation on the power grid, where the battery needs to dump and absorb power in short, intense bursts.

Cycle Life and Longevity

The Economic Reality Check: Why Sodium Wins on Scale

Sodium is the sixth most abundant element in the Earth's crust. It is geographically accessible to every continent, standing in sharp contrast to the "white gold" rush of lithium-rich regions.

Real-World Applications and Market Entry

The "future" of sodium-ion arrived between 2023 and 2025. CATL has already moved past its first-generation 160 Wh/kg cells, and we are seeing the first hybrid packs—mixing sodium and lithium cells—to balance range and cost in the automotive sector.

Primary Segments for Deployment

-

Stationary Energy Storage: This is the immediate winner. Weight and volume matter far less for a containerized grid battery than for a car, making sodium’s cost and safety benefits the deciding factors.

-

Micro-mobility: E-scooters and e-bikes represent a massive market where price sensitivity is extreme. Sodium-ion is a safer, more durable replacement for lead-acid and low-end lithium cells.

-

Urban Commuter EVs: For "city cars" with a 150-mile range, sodium-ion provides a path to affordable electric transport without the premium price of high-nickel chemistries.

The Scaling Bottleneck: Hard Carbon and the SEI Problem

The transition to a sodium-based economy is currently stalled by the "Valley of Death" in manufacturing. The industry is grappling with the supply chain for hard carbon anodes, which is nowhere near as mature as the graphite market. There are also persistent issues with the Solid Electrolyte Interphase (SEI)—the layer that forms on the anode during the first charge. If the SEI isn't stable, the battery suffers from gas evolution and rapid capacity loss.

"Bankability" remains a hurdle. Large utility projects require five to ten years of field data before financiers feel comfortable. As players like HiNa Battery and Faradion deploy MWh-scale systems throughout 2025 and 2026, this data gap is narrowing. Sodium-ion is not a "lithium killer." It is a relief valve. By taking over the cost-sensitive, stationary, and low-speed roles, sodium allows lithium to be reserved for high-performance aviation and long-range trucking where its energy density is truly irreplaceable.