Major Tech Firms Meta and Google Delay Undersea Cable Projects Amid Red Sea Security Concerns

Key Cable Projects Face Significant Setbacks

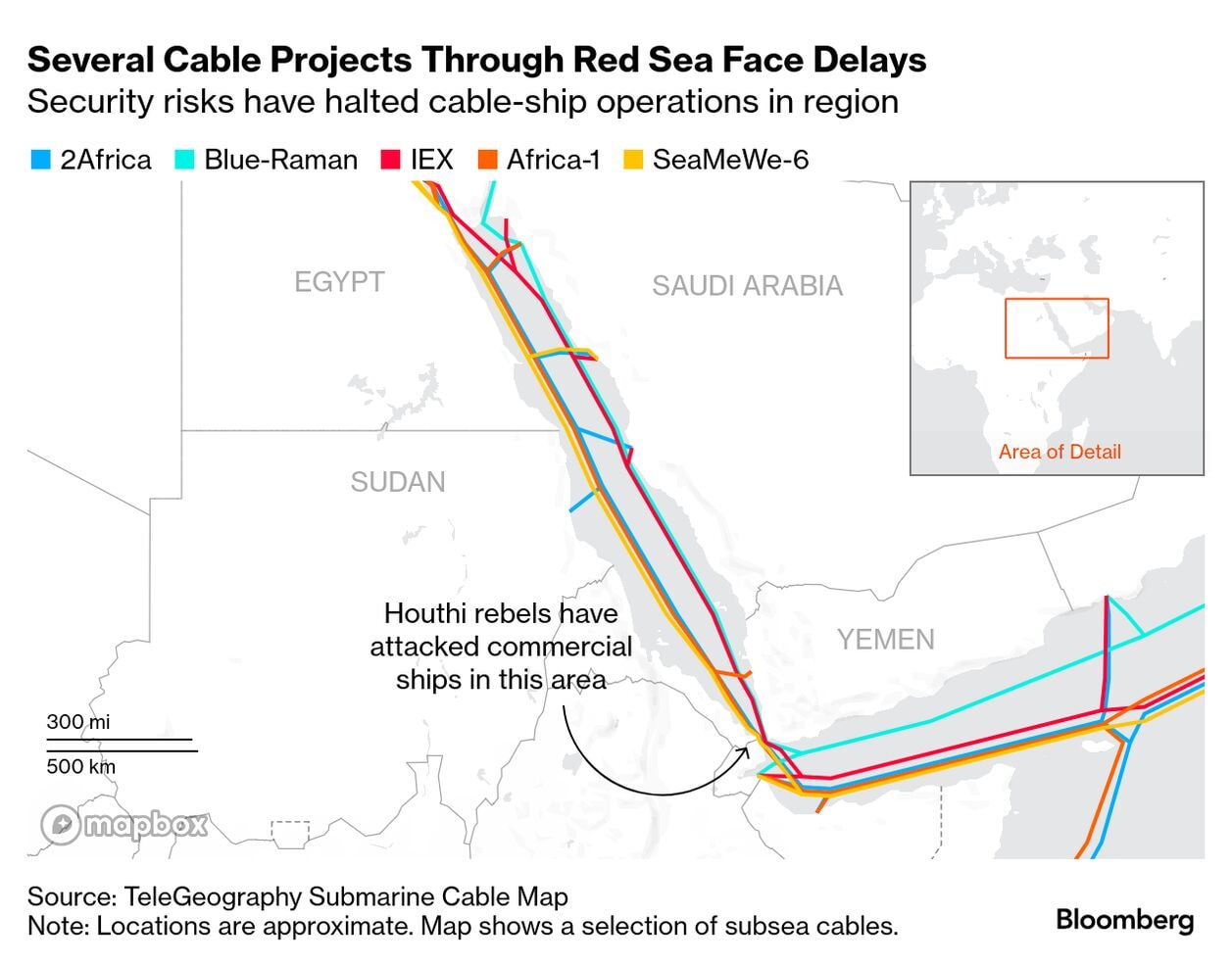

Meta's 2Africa subsea cable system, a colossal 28,000-mile (45,000 km) project initially announced in 2020, aims to encircle the African continent, delivering fiber internet and connecting Europe with Asia and Africa. Designed to connect 33 countries with a capacity of up to 180 terabits per second (Tbps), it incorporates advanced optical switching for dynamic bandwidth allocation, improving traffic optimization. However, the company has encountered substantial issues in the southern Red Sea. A Meta spokesperson attributed the holdups to "a range of operational factors, regulatory concerns and geopolitical risk," with a key section stalled due to regional conflicts and difficulties securing necessary permits from local governments. Only 80% of the cable has been laid, with the Red Sea segment stalled since early 2024. Meta is reportedly exploring rerouting options for this segment, potentially adding over 1,000 miles and pushing completion to late 2026.

Similarly, the Google-backed Blue-Raman intercontinental cable system, first unveiled in 2021, has also been delayed. This dual-system project, designed for a ready-for-service (RFS) date of Q4 2024, was intended to link countries including France, Italy, India, Israel, Jordan, Saudi Arabia, and Oman. Google's Cloud Blog and Equinix partnerships confirm its route, with a design capacity exceeding 200 Tbps utilizing space-division multiplexing (SDM) technology for higher fiber pairs. While Google has not provided an updated timetable, Telegeography's Q3 2025 report verifies no progress in its Red Sea crossing since mid-2024 due to security issues. Contingency plans for satellite backups have been mentioned in Google's Q4 2025 outlook, as the Middle East-to-India Raman leg remains paused.

Red Sea Instability Impacts Critical Infrastructure

The Red Sea region has become a major flashpoint for infrastructure development. Builders working on numerous fiber internet cables in the area have reportedly experienced repeated missile attacks, allegedly by Iran-backed Houthis. U.S. Department of State briefings and International Maritime Organization (IMO) alerts document over 50 incidents since November 2023 targeting vessels, including those involved in cable-laying, forcing lengthy detours and disrupting work. This has led to a 40% delay rate for Red Sea projects, significantly higher than the global average of 10-15%. Industry forums reflect concerns over these disruptions, which could increase project costs by 15-20%.

Alan Mauldin, research director at telecommunications firm Telegeography, noted that these delays prevent companies from "monetiz[ing] their investments by sending data over these cables" and compel them "to purchase capacity on alternative cables to meet their near-term requirements." This has led to over $500 million in opportunity costs for operators. Saudi Arabia and Oman have granted landing permits for Blue-Raman, but segments through Jordan and Israel face regulatory hurdles due to ongoing geopolitical tensions.

Broader Context and Unaffected Projects

Despite these significant setbacks, the delays are not expected to impact all ongoing projects by Meta and Google. Google continues construction on a cable connecting Togo to Europe, which wraps around the Atlantic side and is progressing on schedule. Meta is also advancing with a separate gigantic cable system designed to connect five continents, explicitly avoiding the Red Sea corridor. Both of these projects are progressing on schedule for a 2026 RFS.

Undersea cables are vital for global fiber internet delivery, but they inherently carry risks beyond geopolitical conflicts. The International Cable Protection Committee (ICPC) reports that natural disasters, extreme weather, and human activities like fishing or anchor drags typically cause over 150 global faults annually. The Red Sea itself is tectonically active, adding another layer of risk from earthquakes. These developments underscore a broader trend where Big Tech, now controlling about 20% of global subsea capacity, is increasingly diverting investments to safer routes like the Pacific or Arctic due to heightened security concerns in historically critical maritime passages.