DoorDash vs. Instacart: The AI Grocery War Gets Real (and Messy)

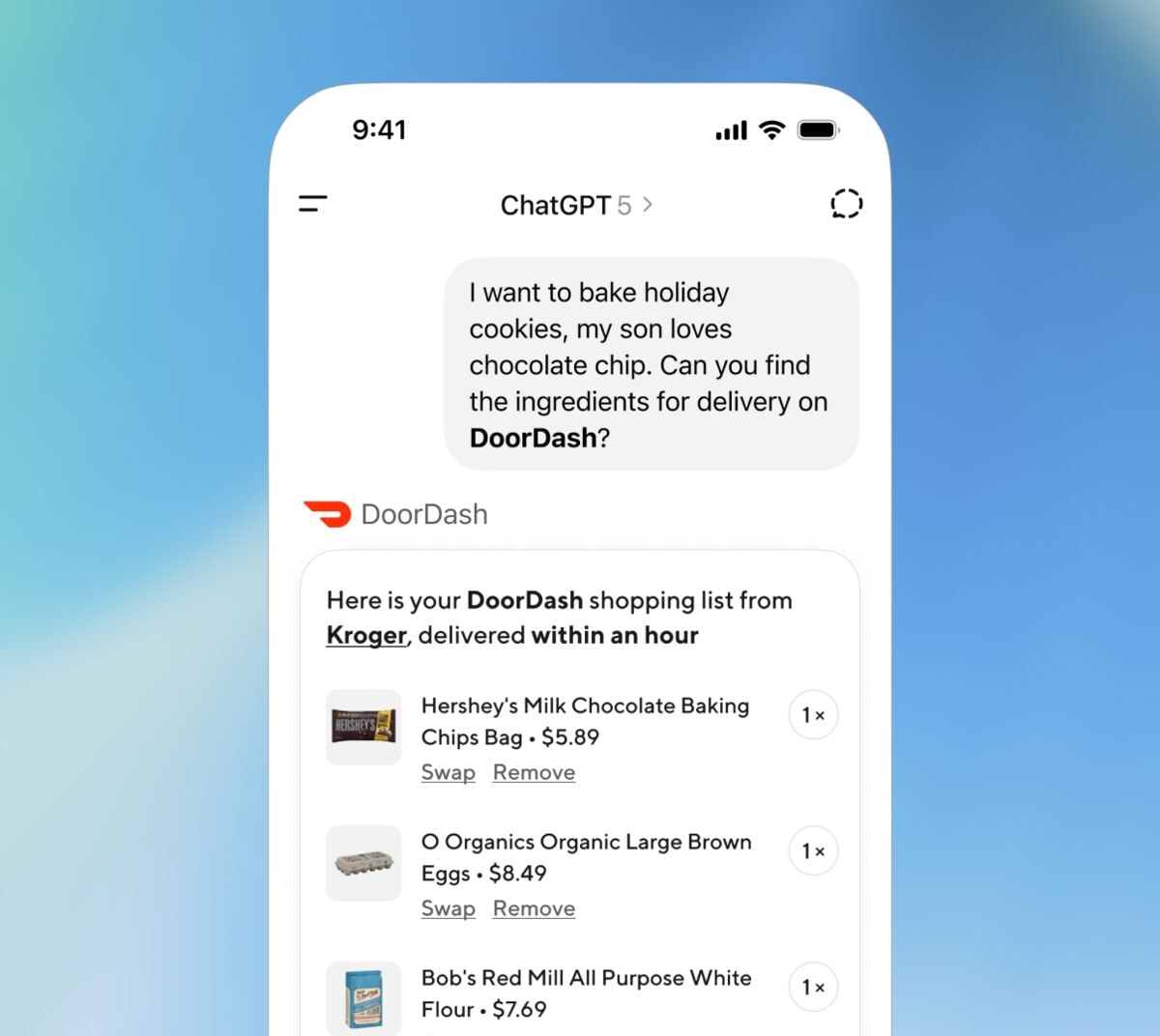

DoorDash is done playing catch-up. After a month of quiet updates and a late-November splash, the delivery giant has fully tethered its grocery service to ChatGPT. It’s an aggressive play to hijack the "what’s for dinner?" conversation before a user even thinks about opening a dedicated shopping app. While Instacart pioneered this space in 2022, DoorDash is betting that its "multi-category" reach—the ability to toss a bottle of Advil and a burrito in with your grocery haul—will finally make AI commerce more than a tech demo.

Early data from the mid-December rollout suggests the gamble is paying off, at least on paper. DoorDash reports its system is currently handling roughly 5,000 grocery-related conversations daily. CEO Tony Xu has been vocal about this being a "bridge" between digital planning and physical delivery, but the subtext is clear: DoorDash is chasing Instacart’s core market by embedding itself into the tools people already use to organize their lives.

From Meal Plan to Checkout: The Seamless Myth?

The selling point is simple: you ask ChatGPT for a gluten-free meal plan, and it populates a DoorDash cart with every ingredient from a local Kroger or Whole Foods. DoorDash claims this workflow slashes ordering time by 40% compared to navigating its standalone app.

However, that "speed" metric deserves a healthy dose of skepticism. While the technical integration via OpenAI’s API is slick, it ignores the inherent latency of LLMs. For many users, typing a specific prompt, correcting the AI’s inevitable errors, and then verifying the cart can take significantly longer than the "reorder favorites" button on a traditional UI.

The real differentiator isn't just the AI—it’s the logistics. By utilizing its existing fleet, DoorDash is clocking delivery times at a 30-minute average for these AI-driven orders. That’s a significant lead over the 45-to-60-minute window typical of Instacart, turning the "AI meal planner" from a weekend project into a viable solution for Tuesday night’s dinner panic.

The Reality Check: Inventory and "Hallucinated" Groceries

Despite the hype, the transition from chat to kitchen isn’t always smooth. Social media reports from the first three weeks of December highlight a recurring "UX friction": the AI often suggests recipes requiring ingredients that local retail partners don’t actually stock.

The "parsley problem" has become a meme among early adopters—cases where the AI erroneously adds twelve bunches of a herb when the recipe calls for twelve ounces, or suggests out-of-stock premium items that trigger frustrating "item unavailable" notifications at the final checkout stage. Approximately 20% of user feedback on platforms like Reddit centers on these inventory glitches. For a service sold on convenience, these hallucinations create a manual overhead that threatens to negate the time saved by the AI.

Shifting Market Turf

The final quarter of 2025 has seen a measurable shift in the delivery landscape. Bloomberg reports that DoorDash’s grocery segment grew 12% year-over-year in Q4, outstripping Instacart’s 8% growth in the same sector. The ChatGPT feature alone handled 200,000 queries in its debut week.

While Instacart still holds the crown for sheer retail volume—boasting 1,400 partners to DoorDash's 500+—DoorDash is winning on engagement depth. Users are spending an average of 4.5 minutes per session within the ChatGPT interface, double the time spent on traditional shopping apps. This "stickiness" is particularly potent in high-density hubs like New York and Los Angeles, where 60% of beta users were concentrated.

Data Walls and Geographic Borders

For now, this AI-driven grocery experiment remains a uniquely American phenomenon. While Reuters has hinted at a Q1 2026 expansion into Canada and Australia, DoorDash is steering clear of Europe. The regulatory headache of GDPR compliance regarding data sharing between OpenAI and DoorDash remains a primary roadblock.

Privacy-conscious users in the U.S. are also raising eyebrows. The integration requires a level of data-swapping—dietary preferences, location data, and purchase history—that makes some early adopters uneasy. As DoorDash moves into 2026, its biggest challenge won't just be refining its inventory algorithms, but proving to users that their dinner habits aren't being mined for more than just a faster delivery time.