Apple Silicon Hits 20% Laptop Market Share, Matching AMD in Historic Shift

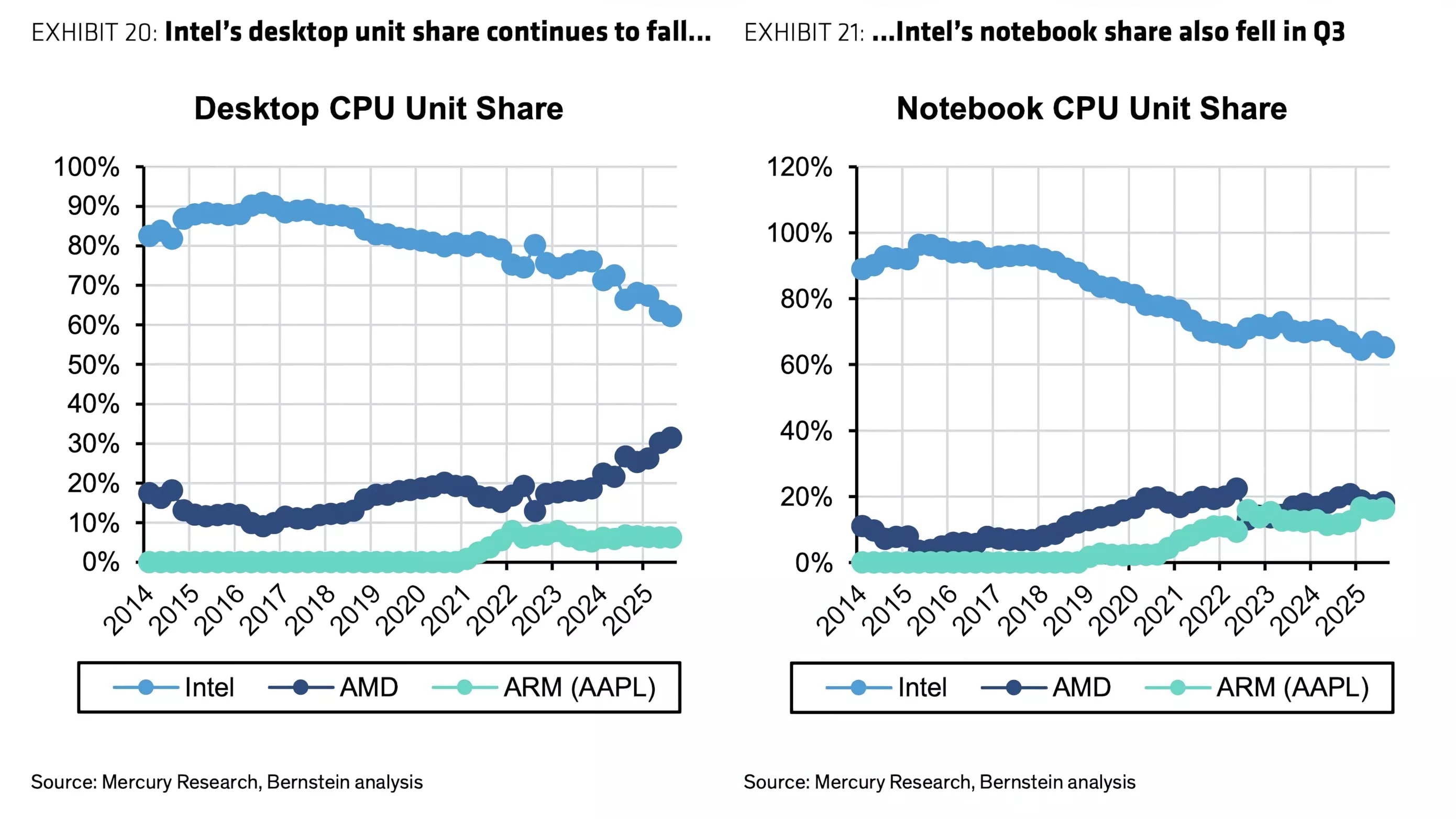

Apple has reached a major milestone in the semiconductor industry, effectively dismantling the long-standing x86 duopoly in portable computing. According to the latest figures from Mercury Research and Bernstein Research, Apple’s laptop CPU market share has climbed to approximately 20%. This surge puts Apple in a statistical dead heat with industry veteran AMD.

This structural market shift has happened with remarkable speed. Only five years ago, the laptop sector was defined by Intel’s near-total dominance and AMD’s hard-fought incremental gains. Today, Apple has leveraged its proprietary architecture to secure a fifth of the entire market—a feat achieved in record time since the M1 chip debuted in late 2020.

The Rapid Ascent of Custom Silicon

The transition from being an Intel customer to a top-tier silicon rival was surprisingly brief. When Apple launched its first Arm-based M1 SoC, the objective was to maximize macOS performance while achieving battery life that x86 processors of that era could not match. Data from the 2025 calendar year confirms that this strategy has been executed with high precision.

As Apple enters its sixth year of the custom silicon era, its laptop market share has stabilized between 18% and 20%. This puts the company in direct competition with AMD, which currently holds between 21% and 22% of the laptop sector. For a single hardware manufacturer to match the scale of a merchant silicon provider like AMD—which supplies dozens of major OEMs including HP, Dell, and Lenovo—is unprecedented in the modern computing era.

Intel’s Shrinking Footprint

The growth of Apple and AMD has come at a direct cost to Intel. Historical data shows a clear erosion of Intel's once-impregnable position. In 2015, Intel’s share of the laptop CPU market was nearly 100%. By the end of 2025, that figure had dropped to just over 60%.

While Intel remains the majority stakeholder, the pressure is multi-fronted. In the desktop segment, Apple has secured a 10% market share, while AMD has capitalized on Intel's recent architectural struggles to claim more than 30%. The trend is consistent: any market share lost by Intel is being aggressively redistributed between AMD’s Ryzen lineup and Apple’s M-series chips.

The 20% Tipping Point: Why It Matters

For software developers, a 20% market share represents a critical tipping point where Arm-native optimization moves from a "nice-to-have" to a mandatory requirement. This "critical mass" ensures that the Arm ecosystem is now a mainstream priority for enterprise and creative software suites alike. Apple’s vertical integration allowed it to force this shift quickly, but it is no longer the only player challenging the status quo.

The landscape is further complicated by the arrival of credible Windows-on-Arm competitors. Qualcomm’s Snapdragon X Elite series has finally provided Windows OEMs with a viable alternative to x86, while Intel has responded with its "Lunar Lake" architecture in an attempt to reclaim the efficiency lead. With Apple and AMD now commanding nearly 40% of the laptop market combined, the industry is no longer waiting for x86 to catch up.

What This Means for Consumers

For the average user, this three-way race has fundamentally changed expectations for portable hardware. The primary "So What?" is the new floor for battery life and thermal management; Windows OEMs can no longer afford to ship loud, power-hungry laptops if they want to compete with the efficiency standards set by the MacBook Air.

While AMD continues to see strong growth—hitting record highs in the desktop segment—the laptop market is no longer a lopsided duopoly. It is a genuine three-way battle where Apple has moved from an underdog to a market-defining force. As Apple continues to refresh its Mac lineup with more powerful M-series designs, the research indicates that its penetration of the PC market shows no signs of slowing down.