Apple’s Samsung Monopoly Just Hit a Massive Wall

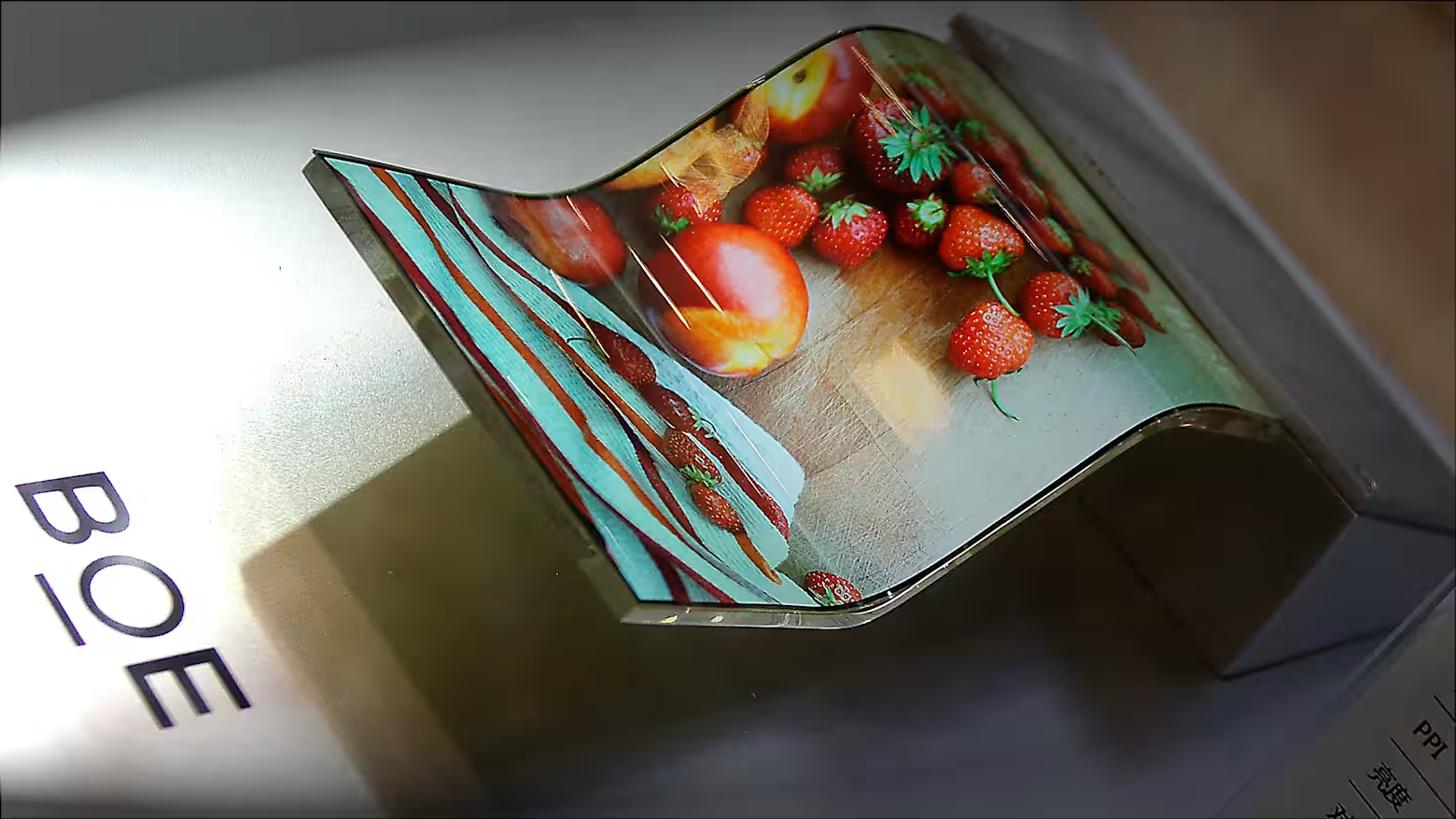

Apple’s multi-year crusade to break Samsung’s stranglehold on iPhone displays has stalled. Millions of OLED panel orders originally destined for Chinese giant BOE are being redirected to Samsung Display after a series of manufacturing failures effectively paralyzed BOE's dedicated iPhone lines. This isn't just a minor technical "kink"—it’s a supply chain emergency that forces Apple back into the arms of the one partner it has been trying to sideline for years.

Yield Crashes and Technical Regression

The nature of the failure is particularly damning. Usually, yield issues are reserved for cutting-edge Low-Temperature Polycrystalline Oxide (LTPO) panels. But BOE’s lines are currently choking on the older, less complex Low-Temperature Polycrystalline Silicon (LTPS) panels used in the iPhone 15 and 16.

Industry analysts point to potential contamination issues during a rushed retooling phase or, more likely, persistent failures in thin-film encapsulation (TFE)—the process that protects organic material from moisture. Without a perfect seal, the panels develop "dark spots" or catastrophic light leakage. This regression in a mature technology is a massive red flag for Cupertino. If BOE cannot reliably build yesterday's screens, it cannot be trusted with tomorrow's flagships.

Samsung Reclaims the High Ground—and the Leverage

Samsung Display is the sole winner in this chaos. Over the last 60 days, the South Korean firm has absorbed millions of redirected units. This isn't just a win for Samsung’s bottom line; it’s a strategic nightmare for Apple’s procurement team.

Samsung’s yields remain locked in the mid-90s, dwarfing BOE’s struggling 85%. While Apple prefers a diversified supplier base to drive prices down, this latest failure hands Samsung immense leverage. For the upcoming iPhone 17 Pro cycle, Apple’s negotiating hand is effectively broken. Samsung knows Apple cannot risk a stockout, and it will likely price its premium panels accordingly.

The redirected orders are vast. They span the entire portfolio: iPhone 13, 14, 15, 16, and the upcoming iPhone 17. Even the budget-focused iPhone 16e, which was supposed to be a high-margin win for Apple using cheap BOE glass, is now being shifted to Samsung’s more expensive, higher-quality lines. Apple’s hardware margins are about to take a visible hit.

BOE’s High-Stakes Hail Mary: The iPhone 17e

The fallout has gutted BOE’s 2025 performance. The company missed its annual target of 40 million units by a wide margin after the second-half production collapse. Legal pressure is mounting simultaneously; Samsung’s ongoing patent infringement lawsuits and a preliminary U.S. import ban on certain BOE technologies have created a "no-buy" zone for many of Apple's secondary partners.

BOE is now pivoting toward a single goal: the iPhone 17e launch this spring. It currently holds the largest allocation for this specific model, but it is a "make-or-break" contract. If BOE cannot stabilize its lines for the 17e, Apple may be forced to rely on LG Display as its only viable alternative to the Samsung monopoly.

Apple’s patience is famously thin. By failing to scale for the global iPhone 17 launch, BOE has proven that Chinese manufacturing still hasn't closed the "reliability gap" with Korean glass. For the foreseeable future, the "all-screen" iPhone remains a Samsung-powered product.