Apple Dethrones Samsung: How the iPhone 17 Rewrote the Global Market in 2025

Apple ended 2025 as the world’s smartphone king, unseating Samsung with a 20% global market share. While Samsung played a defensive game, relying on its mid-range Galaxy A-series to maintain volume, the strategy crumbled under Apple’s aggressive push into emerging markets and a consumer base that no longer wants "good enough" devices.

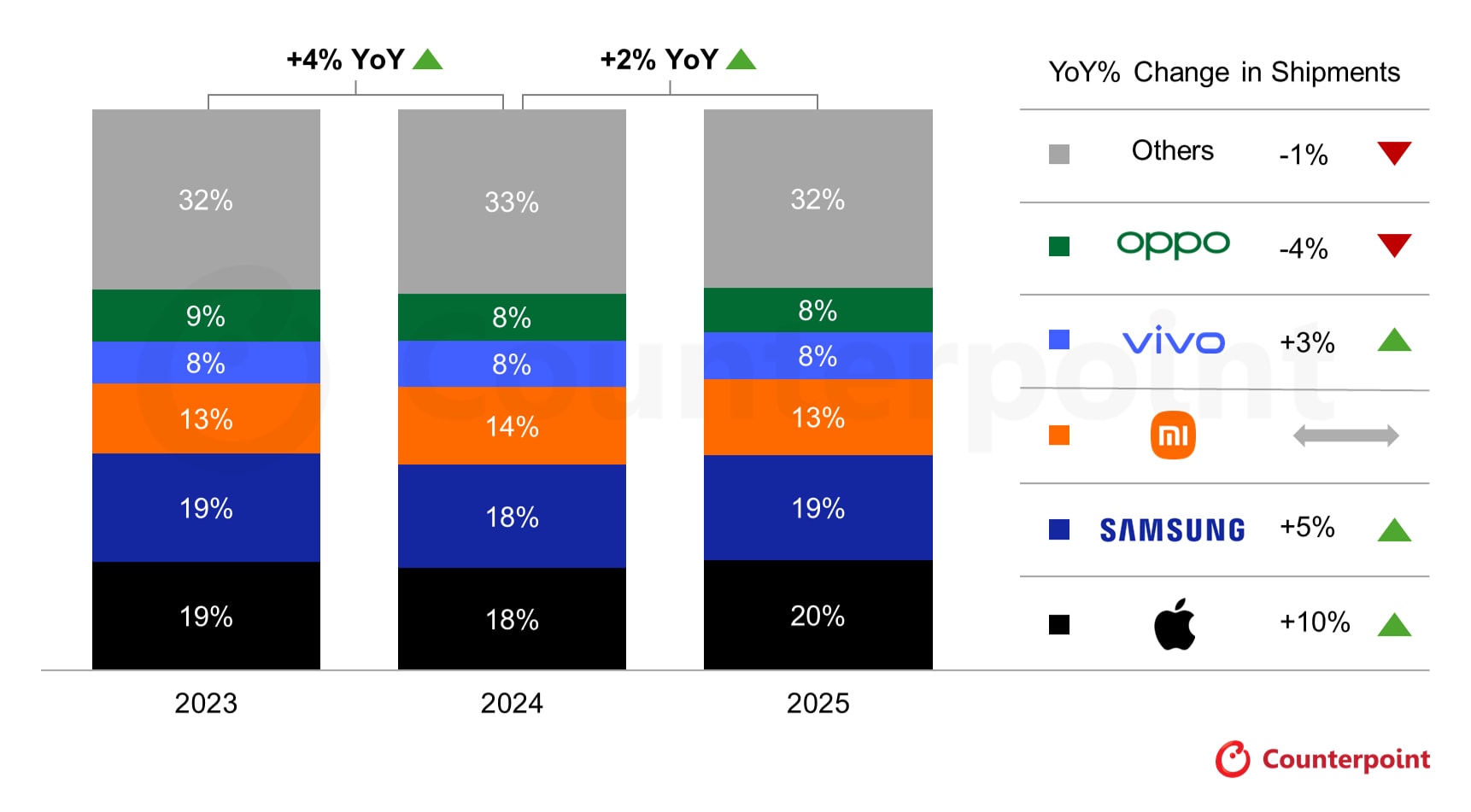

According to year-end data from Counterpoint Research, the industry grew a modest 2% in 2025. This marks a cooling period from 2024’s 4% bounce-back, but the real story isn't the growth—it’s the brutal reshuffling at the top.

The AI Tax and the Death of the Mid-Range

The most significant shift in 2025 wasn't just brand preference; it was a war for silicon. As AI data centers began cannibalizing the global supply of DRAM and NAND memory, smartphone manufacturers faced a choice: pay a premium for components or lose inventory.

Apple used its massive margins to absorb these rising costs, effectively "pricing out" the competition. This scarcity drove the industry toward "premiumization." Consumers, realizing that entry-level phones were becoming more expensive anyway, opted to buy high-end devices as long-term investments. Apple capitalized on this by baking the component cost hikes into the iPhone 17’s price tag, while leveraging aggressive financing and trade-in programs in regions like India and Vietnam. In these markets, Apple didn't just sell phones; it sold "aspirational debt" through carrier subsidies that made the iPhone 17 accessible to the middle class for the first time.

The September 19th Surge

Apple’s path to the top spot was cemented by a massive Q4 "super-cycle." The iPhone 17 hit shelves on September 19, 2025, triggering a replacement wave from millions of users who had been holding onto "COVID-era" devices purchased in 2021 and 2022.

By the final three months of the year, Apple controlled a staggering 25% of all global shipments. This Q4 momentum allowed the iPhone maker to outpace Samsung’s 19% yearly share, despite Samsung seeing its own 5% shipment growth. While Samsung's flagships performed well, they lacked the gravitational pull of Apple's ecosystem during the critical holiday window.

Competition Trails in a High-Tariff Environment

The race for third place remained a battle of value. Xiaomi held its ground with a 13% share, leaning heavily on price-sensitive markets where Apple’s "premium" pitch still hits a ceiling. Oppo and Vivo followed, each capturing 8%.

However, the 2025 data hides a frantic "pull forward" strategy. Fearing looming trade tariffs, several Chinese manufacturers flooded the channels early in the year to build inventory. This artificial boost created a glut that slowed fourth-quarter growth to a crawl (1%), leaving the market top-heavy and vulnerable as we enter 2026.

2026 Outlook: The Silicon Squeeze

The celebration at Apple Park may be short-lived. Counterpoint has already slashed its 2026 shipment forecast by 3%, citing a worsening conflict with the AI sector.

As chipmakers prioritize high-margin AI server components, smartphone brands are staring down a supply desert. "The market is set to soften in 2026 as component costs skyrocket," says Tarun Pathak, Counterpoint’s research director. While Apple and Samsung have the supply chain muscle to secure chips, the rest of the market—specifically Chinese OEMs in the budget tier—face a looming existential crisis.

Apple enters 2026 as the leader, but its biggest challenge won't be Samsung. It will be a global supply chain that is increasingly uninterested in building smartphones when it can build AI instead.