The Death of the Download: How 2025 Broke the App Store’s Infinite Growth Engine

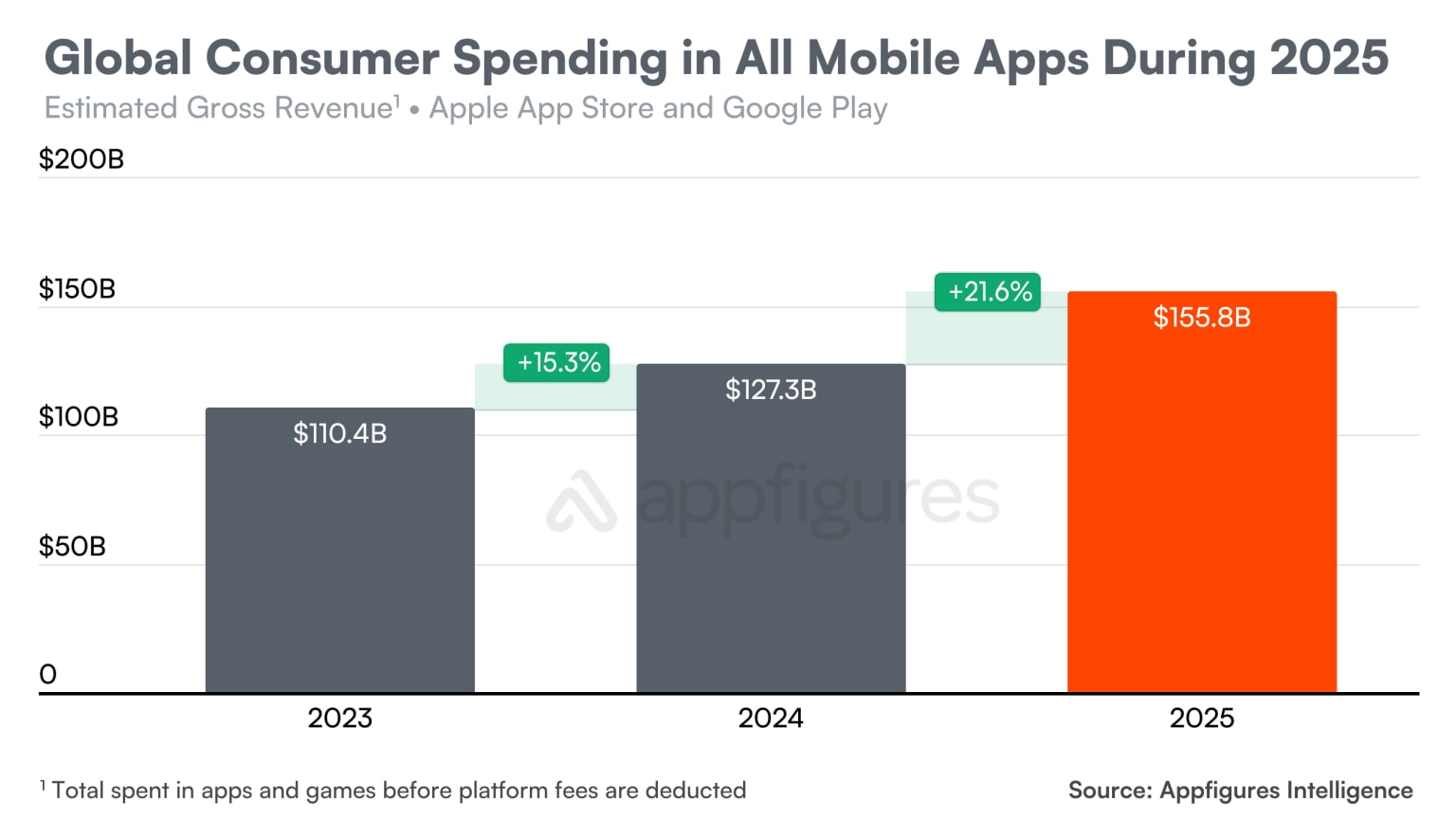

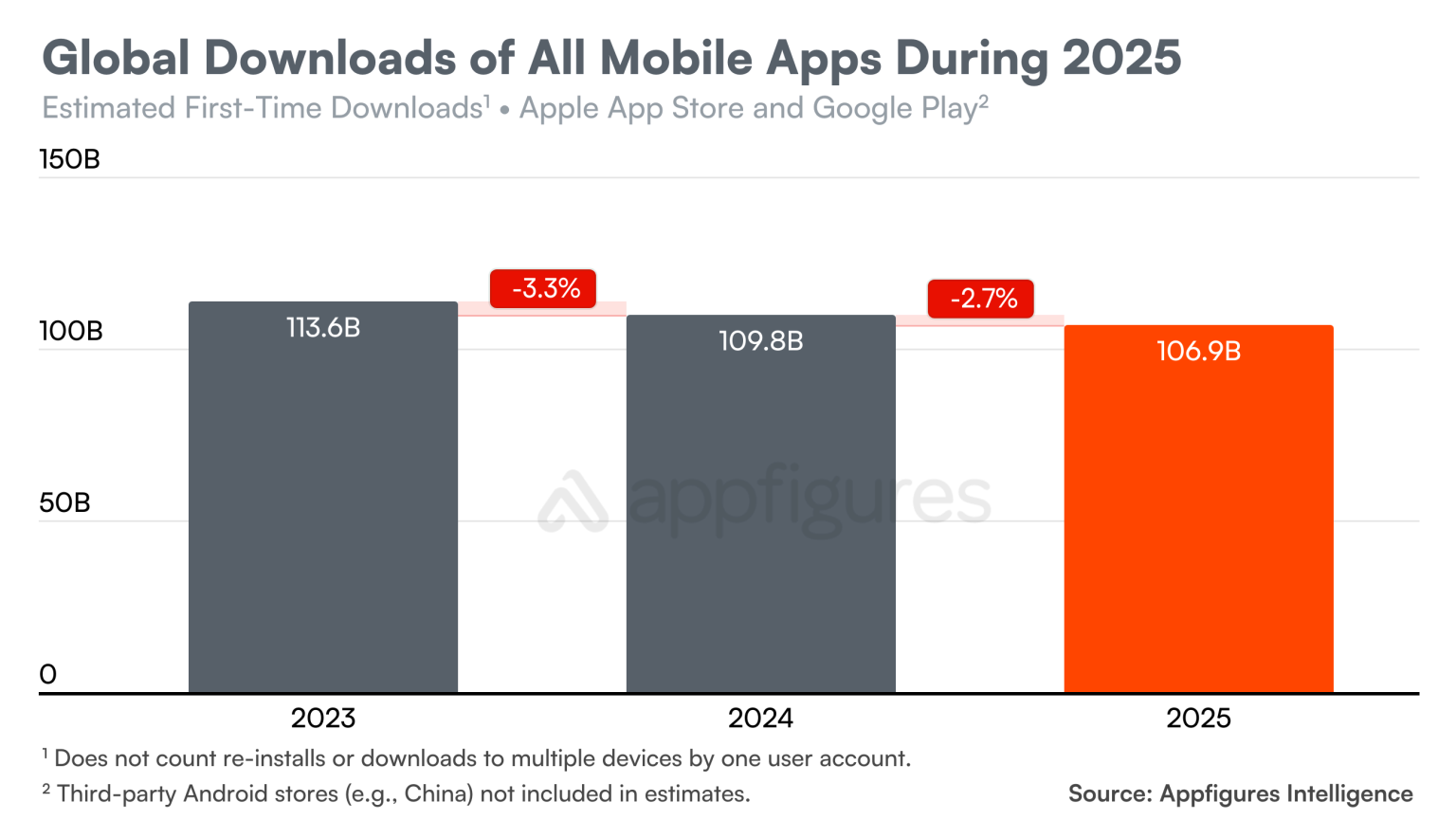

The "gold rush" of the pandemic era has officially evaporated. Appfigures' latest annual report confirms that 2025 was a year of reckoning: global app downloads fell for the fifth consecutive year, tumbling to 106.9 billion. Yet, in a paradox that defines the maturing mobile economy, revenue didn't just grow—it exploded. Global consumer spending hit a record $155.8 billion last year, a 21.6% surge that proves developers have finally figured out how to trade breadth for depth.

This is no longer a market defined by the hunt for new users. The industry has pivoted from a frantic land grab to a high-yield extraction phase, replacing the pursuit of "vanity downloads" with a ruthless focus on the subscription model.

The Gaming Recession and the Non-Game Coup

For the first time in the history of the smartphone, mobile gaming has lost its crown. We are witnessing a decisive "Gaming Recession." While gaming has traditionally been the engine of the App Store, its dominance shattered in 2025. Spending on mobile games grew by a sluggish 10% to $72.2 billion, while non-game apps saw a massive 33.9% year-over-year spike, reaching $82.6 billion.

The shift is stark: games now account for a mere 46% of total in-app spending. The carnage is even more visible in the download metrics, where game installs plummeted 8.6% to 39.4 billion. In contrast, non-game apps remained resilient, edging up 1.1%. This revenue flip is being fueled by a new class of digital essentials. AI platforms like ChatGPT, Perplexity, and Character.AI are no longer experimental novelties—they drove a staggering 112% growth in the AI sector, capturing a massive share of the consumer wallet.

LTV Over Acquisition: The Subscription Pivot

The industry's survival now hinges on Lifetime Value (LTV) rather than User Acquisition (UA). Publishers have stopped praying for viral hits and started perfecting the art of the recurring fee. The United States serves as the primary case study for this shift: consumer spending jumped 18.1% to $55.5 billion last year, even as the total number of new installs in the region contracted by 4.2%.

Consumers have reached a tipping point of "subscription normalization." Whether it is for utility or entertainment, users are now conditioned to pay monthly or annual tolls. This is most visible in the "Film and Television" and "Social Media" categories, both of which generated nearly $12 billion in revenue. In the current landscape, a smaller, dedicated user base is infinitely more valuable than a massive, unmonetized one.

OS Integration and the Erosion of Utility Apps

While the broader market shrinks in volume, the winners and losers are being decided by the operating systems themselves. Finance apps—specifically digital wallets and P2P platforms—notched an 8% increase in downloads as they successfully cannibalized traditional banking.

However, "utility" categories like Weather and News are facing an existential crisis, seeing double-digit declines. This isn't just a change in habit; it’s a result of OS-level integration. When Apple and Google bake sophisticated lock-screen widgets and AI-powered news summaries directly into the firmware, the need for a standalone weather app vanishes. Users aren't just consolidating their habits into "super-apps"; they are letting the operating system handle the basics.

The Retail Correction

The year ended with a sharp divide in the retail sector. General e-commerce downloads in the U.S. underwent a correction of nearly 10% following the 2023–2024 peak. Yet, even as the broader market cooled, international disruptors like Temu and SHEIN bucked the trend, maintaining aggressive engagement levels through gamified shopping.

This contrast mirrors the state of the marketplaces: while Google Play maintains the lead in raw volume, the App Store remains the undisputed king of monetization. As we head into 2026, the strategy for developers is clear: stop chasing the next billion downloads and start proving why you’re worth the monthly bill.